If you are in Supply Chain – regardless of industry – you are probably talking about how to get ‘End-to-End Visibility’ of your supply chain with an emphasis on logistics. That was definitely one of the most buzzed about topics and overused terms at Gartner’s Supply Chain Summit. My favorite quote came during a panel when Tracy Reiss, a long-time supply chain technologist from KBX Logistics, said that she counted 37 exhibitors who had visibility listed as one of their key value propositions. She went on to muse, “If I had a shot for every time I saw ‘visibility’ in the exhibit hall, I wouldn’t be standing!”

While that elicited a laugh, it’s also accurate and paints a picture of the market for visibility tools. The space has gone from brand new to emerging to crowded and will soon face commoditization and consolidation. That is where the most interesting conversations and sessions I saw take off: What will your brand DO with all that amazing visibility data at your fingertips!?

If SCM Visibility is a Commodity, What Can Brands Do With That Data?

There’s an endless number of things one could do with all this data. Taking action based on the data and insights available is top of mind to solve for three things: customer experience, capacity constraints and inventory optimization. Nearly every single conversation came back to one of those three key concerns and the fact that visibility alone is simply not enough.

Improving the Customer Experience

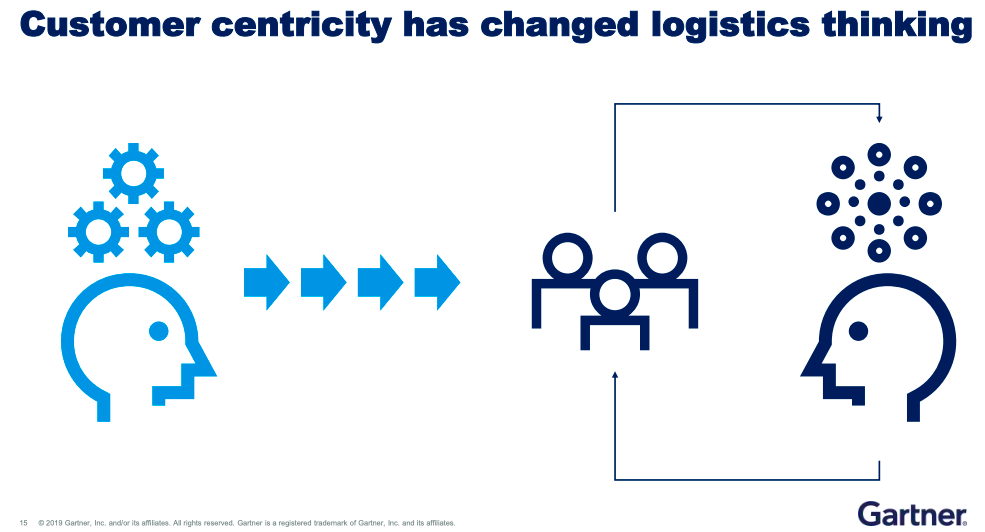

It was validating to hear practitioners, vendors and analysts alike all on stages discussing the CX (customer experience) imperatives. What was deflating was hearing in the hallways, over lunch and in one-on-ones that much of the CX discussion is lip service rather than real investment – at least for the average brand. It’s not totally surprising to know that many of the winners of the Gartner Supply Chainnovators awards are leading companies who in fact DO worry about customer experience and its impact on Lifetime Value (LTV). When their peers ask – how can I be like them but revert to thinking inside out instead of customer first, they are missing the boat. In his session about the future of logistics, analyst David Gonzalez stated that customer centricity has changed logistics thinking. I would argue that the change has just begun and there is a lot more cultural work to do.

Visibility data provides the fuel to power any number of efforts that could improve the customer experience. These efforts not only include the simple understanding of network anomalies and bottlenecks that could be resolved en masse, but they empower brands to proactively handle exceptions before a customer is impacted. Exception management came up in many vendor sessions, but few practitioners claimed participation or even readiness to act on the visibility data at hand.

Takeaway: SCM leaders must expand their thinking about supply chain’s role in the customer journey, seeking out cultural change to adapt to a new era of rising customer expectations. Having access to unfettered visibility data is not enough on its own — retailers must use it to drive better decisions to improve the customer experience and put their customers first.

Managing Through the Capacity Crunch

It’s no secret that there’s a shortage of capacity due to driver shortages, sub-optimal routing, exorbitant dwell times, etc. Companies cannot negotiate their way out of the shortage, nor can they afford to pay more to lock in capacity. It’s clear that visibility data can be mined in myriad ways to learn to identify underutilized capacity – making both drivers and shippers more profitable. Coca Cola discussed its aims to become the ‘shipper of choice’ in the industry, using data, collaboration and even small perks to be the brand that drivers want to support.

Retail shippers can partner with vendors to get insights about actual transit times that will, in turn, inform predictive delivery dates. This enables them to make better, more informed delivery decisions, and it allows them to identify arbitrage opportunities where service classes can be downgraded, while still meeting customer expectations at a more reasonable cost.

Takeaway: When considering shipping visibility partners, determine what data you will need to ingest to do your own analysis, and understand what insights their platforms can generate. Defining the questions you seek to answer up front will help you refine your selection. While Coca Cola remains more focused on the middle mile — sending bottles from the factory to the store — this same mentality is critical in the last mile as well. Retailers should pick visibility players with a unique focus on the last mile and then build a roadmap to leverage said data and insights to optimize both short- and long-range capacity planning.

Optimizing Inventory to Drive Availability and Margins

No one at the event could escape discussions about Amazon’s race to near-real-time shipping, having just learned about one-day shipping capabilities. That announcement is only going to exacerbate shipping issues driving more aggressive behavior and cost pressure on brands trying to replicate that speed. It’s untenable for most retailers to offer next-day shipping on most items – and frankly, consumers don’t even need most things that fast. Analyst Tom Enright continues to advocate the use of price levers and incentives to drive appropriate shipping speed selection, rather than continuing to pursue the race to the bottom.

How does visibility data play a role here? A supply chain leader from AbbVie shared how his organization uses visibility data in the middle mile to reduce transit times, thus lowering safety stock needs and inventory costs for their high value items. Retailers can apply the same practice in high value categories or use returns data to mine customer held inventory to reduce over-ordering. With returns approaching 30% in some categories, many retailers find that returns inventory is their second largest ‘warehouse’. Additionally, combining predictive delivery times with inventory data can inform forward stocking strategies that enable customer choice combined with speedy delivery.

Takeaway: The use cases that employ visibility data are vast, and while the category may be getting commoditized, not all visibility data is created equal. Ensure that shipping visibility data is included in your list of assets when it comes to inventory management, and probe for optimization use cases when designing your reporting and analysis.

Suffice it to say that visibility has landed, but that visibility is not enough. What will you do with all that data your teams can access? How will you take action to improve business outcomes for your brand and customers!?

Learn how successful brands are using their visibility data to take action on delivery variables in the last mile, resulting in happier customers and more efficient transportation.