The COVID-19 outbreak has turned retail on its head. As rest-in-place orders cause store closures, more shoppers are going online than ever before to get their items, including essentials like groceries and medicine. According to Boston Consulting Group’s Arnold Kogan, since the coronavirus outbreak took hold in the U.S., there has been a 40% spike in new shoppers.

Accordingly to our annual surveys, customer expectations are seemingly always on the rise. However, with so many new shoppers, new circumstances, and new uncertainty around retail supply chain, we wanted to understand what shopper preferences look like during this unprecedented time. We surveyed over 1,000 shoppers to understand if shopper preferences have changed around communication in the during the customer journey and in the post-purchase experience.

Supply Chain Shortages Bring New Standards Across The Board

It’s no surprise that retailers have had to flex in new ways since the outbreak began. Retailers with an omnichannel presence have had to pivot to obtain more sales through eCommerce and leverage their physical locations in new ways. Other retailers, especially in grocery, CPG, and fitness have seen massive spikes in order volume, and they have had to ensure they had the capacity to quickly scale, just as they do during peak season.

Despite Bullwhip Effect And Uncertainty, Shoppers Expect Retailers To Understand Upstream Inventory Changes

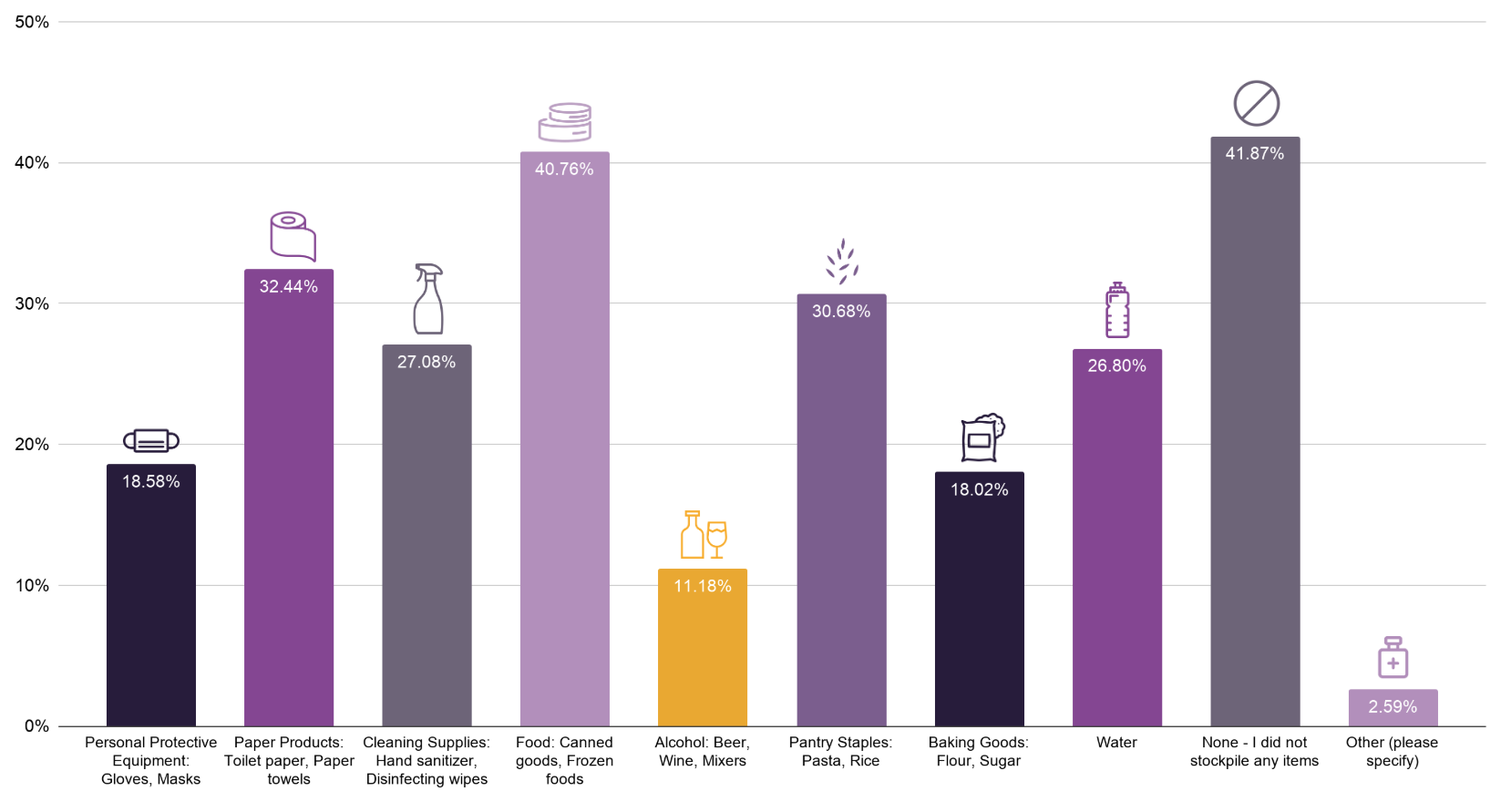

When the outbreak began, hoards of shoppers rushed to their nearest grocery stores, or looked to find the next available delivery window online. According to our survey, almost half (42.4%) of shoppers stockpiled hand santizer and toilet paper at the beginning of COVID-19 causing shortages of these items. Younger shoppers were more likely to stockpile items as well — 53.4% of shoppers aged 18-29 said they stockpiled items, while only 32.6% of shoppers 60+ said they stockpiled on items. Demand for paper products was up by 41%, according to Arnold Kogan, in a Business Insider webinar.

Survey Question: Which of these essential items did you stockpile in preparing for the COVID-19 pandemic? (Check all that apply).

While consumers understood what was happening, many still expected their retailers to stay up-to-date with fast-moving inventory, and communicate it online. Almost 4 out of 10 (39.7%) shoppers still expect retailers to have all items in stock when they shop online. This is higher than the average rate of cart abandonment when consumers find stock-outs (31%, according to an ECR Europe study).

Post-Purchase Communication Best Practices In Light Of COVID-19

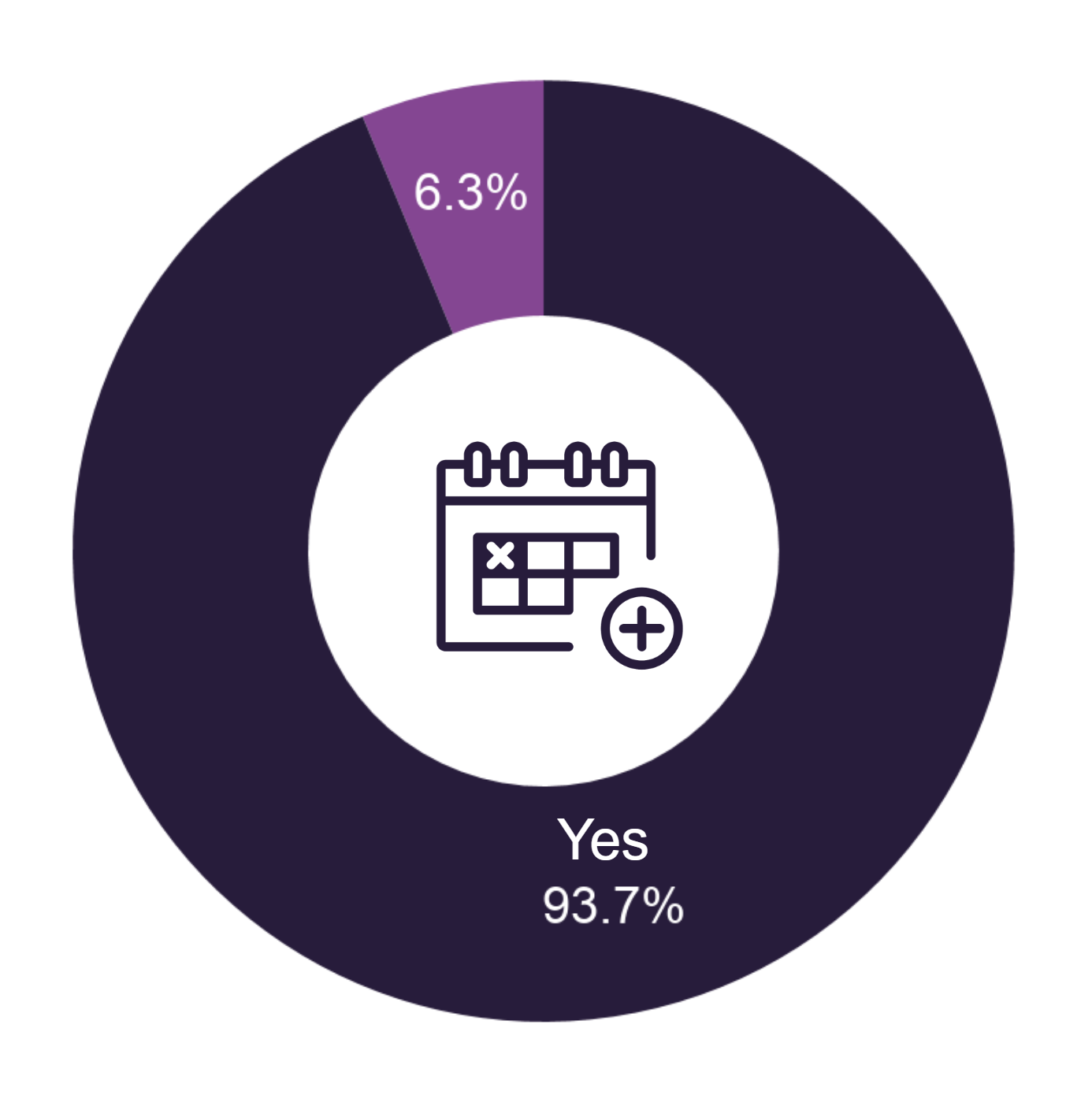

All retailers have had to deal with the compounding effects of short supply upstream, warehouse outbreaks, and truck driver shortages, causing slower deliveries across the board. Because of these changes, even Amazon has said that its one-day delivery promise is no longer feasible, especially for non-essential items. Still, the eCommerce behemoth is more popular than ever, and it has even boasted spikes in new subscribers due to its convenience and reliability. Luckily, shoppers are understanding that there are delays during this time, and are willing to accept slower delivery.

Shoppers in our survey indicated that they are understanding of slower delivery times and delays, as long as the retailer is communicative about those changes upfront. The stakes are incredibly high for brands to do this: If any package is delayed, and the consumer is not informed, 69.7% of shoppers would be less likely to shop with that retailer again. A full 12.5% said that they will absolutely not return to that retailer. This is especially true for younger shoppers. Consumers under the age of 45 were 1.04X less likely to return due to an ordeal with their retailer than shoppers over the age of 45. [Check out our Parcel Network Pulse Dashboard to understand national trends around order volume spikes, delivery exceptions, and more.]

We put together some best practices on communicating with shoppers during COVID-19 based on our survey results.

- Notify shoppers that deliveries may be delayed due to COVID-19 as early as possible: Many retailers, especially in beauty, apparel, and more, have opted to put this notice on the home page so shoppers can expect to see changes in their carts. According to our survey data, the practice of putting the EDD (estimated delivery date) in the cart actually increases conversion rate during this time. 75.1% of shoppers say that putting the delivery date on the product page or in the cart positively influences their decision to buy the item.

- Be transparent about your delivery date, and make promises you can keep: In our survey, almost all shoppers (97.8%) said that it is at least somewhat important for retailers to indicate the delivery date that their items will arrive.

- Send alerts to let the shopper know when their delivery or deliveries will arrive: After the shopper hits the “buy” button, the shopper journey is far from over. When it comes to delivery communication in times of stress and uncertainty, the more the merrier. In times of stress and uncertainty, 68.5% of shoppers said they preferred more communication around the item availability and delivery status. Alerts can be sent through track and trace mechanisms such as the branded tracking page, email, and SMS.

- Have a plan of action in place if you can’t keep your promise date: Proactive action and empathy go a long way in avoiding spikes in WISMO calls (WISMO is short for “Where is my order?”), and even worse, lost customers. To keep consumer confidence high, alert customers immediately if the EDD (estimated delivery date) changes, and let them know if they have other options to receive credit or loyalty points.

[Get even more crisis communication tips here]

Last Mile Reliability: The Key To Keeping Consumer Confidence High

As you move through this time of uncertainty, additional transparency into the delivery experience gives shoppers more certainty, and understand that we are all moving through this together. Be upfront, be transparent, and be proactive to win over consumer confidence in the near-term, and in months to come.

Want to see more statistics from our survey, do you want to read more about our coronavirus coverage? Check out the following:

- The press release from our COVID-19 delivery preferences survey goes over more key findings on shopper wants and needs during this unprecedented time.

- Our Parcel Network Pulse Dashboard pulls together our data of over 3 billion shipping events to help retailers identify where eCommerce fulfillment disruptions are happening.

- As COVID-19 impacts ripple across the supply chain, what should retailers do to keep customers happy? Stay up to date with trends and best practices in our blog, Managing Coronavirus: How Can Retailers Mitigate Supply Chain Shock?

- With so much uncertainty in the next few months, what should retailers focus on in 2020? Forecasting Supply Chain Resilience in 2020 goes over trends and insights we’re hearing from experts and top retailers.