How Advanced Analytics Helps Retailers Compete Against Behemoths Like Amazon And Wayfair

11x – that’s how much Amazon’s shipping and fulfillment costs have risen since 2010. These costs, once representing ~16% of the eCommerce behemoth’s sales, now equate to a full quarter of topline revenue. Meanwhile, Wayfair, the large format category leader that has quietly built a bespoke 3PL called Castlegate, recently reported a net loss of over $500 million, more than double the company’s net loss from the prior year.

What do these market leaders have in common? Both are experiencing record growth in active customers, and both are investing upwards of 25% of their revenue back into delivery at the expense of short-term margins — also, they are winning. But why?

Amazon And Wayfair Are Digging A Moat With Their Transportation Networks

Both companies are setting a standard with their delivery options — fast, free shipping on a myriad of products, installation upgrades at reasonable prices, delivery appointments and your choice of delivery date. The research is clear, consumers now demand this choice and convenience of their retailers, and retailers are scrambling to keep up. If you think investing 25% of sales into the delivery experience seems costly, you haven’t been paying attention.

These two companies invest a quarter of their revenues to build massive logistics business units, vertically integrating delivery to gain complete control and visibility into the post-purchase experience. Ultimately, Amazon and Wayfair are investing in their data infrastructure, betting that better qualities and quantities of data will help them get closer to their consumers. These companies betting on a future where consumer loyalty will earn them profits, while they sell their logistics expertise to other retailers in need.

Across the board, retailers need to figure out how to maintain and increase market share in a world where they are fully reliant on partnerships with an ever-growing list of common carriers, 3PLs, fulfillment partners, and dropship vendors.

Where Amazon and Wayfair control the data, and ultimately the outcomes of their delivery machine, other retailers must create and enforce standards with partners with whom they have little visibility or control. Retailers who do not do this effectively — and soon — are betting against their futures.

Competing Requires Strong Data Management

When we talk to retailers today, they almost universally discuss how to approach the competitive challenge. Rather than just investing in superficial customer experience (CX) efforts like branded tracking pages and delivery alerts that mask the issue, retailers must tackle foundational issues head on. Leaders must lean in to make investments in operations that change real outcomes.

Where Amazon buys and controls 20 cargo planes, another retailer must invest in the ability to track and manage a partner’s planes. Where Wayfair builds forward stocking warehouses across the nation, and develops a fleet capable of delivering their furniture to the highest standards, another retailer must be able to manage the same services — however, their couches will be delivered by a third-party. Where both players have access to a massive arsenal of data from vertical integration, retailers who go it alone lack the scale and insights to make predictive, intelligent choices that optimize cost and delivery experience.

Where Amazon and Wayfair control the data, and ultimately the outcomes of their delivery machine, other retailers must create and enforce standards with partners with whom they have little visibility or control.

The key to solving operational problems lies within the data. The ability to solve bigger problems requires the ability to see and understand what is causing them. You need to be able to distinguish between a blip and a trend. You need to be able to do this across as many partners as is required to compete without sacrificing cost, speed or quality. And, you need to be able to predict when issues are going to occur, before it’s too late to do anything about them.

Without data, there is no context into problems. Without data, there is no control over the outcome. But without the ability to aggregate data and analyze the inputs, even the best data is meaningless.

Convey’s Predictive Analytics Help Retailers Fight Back

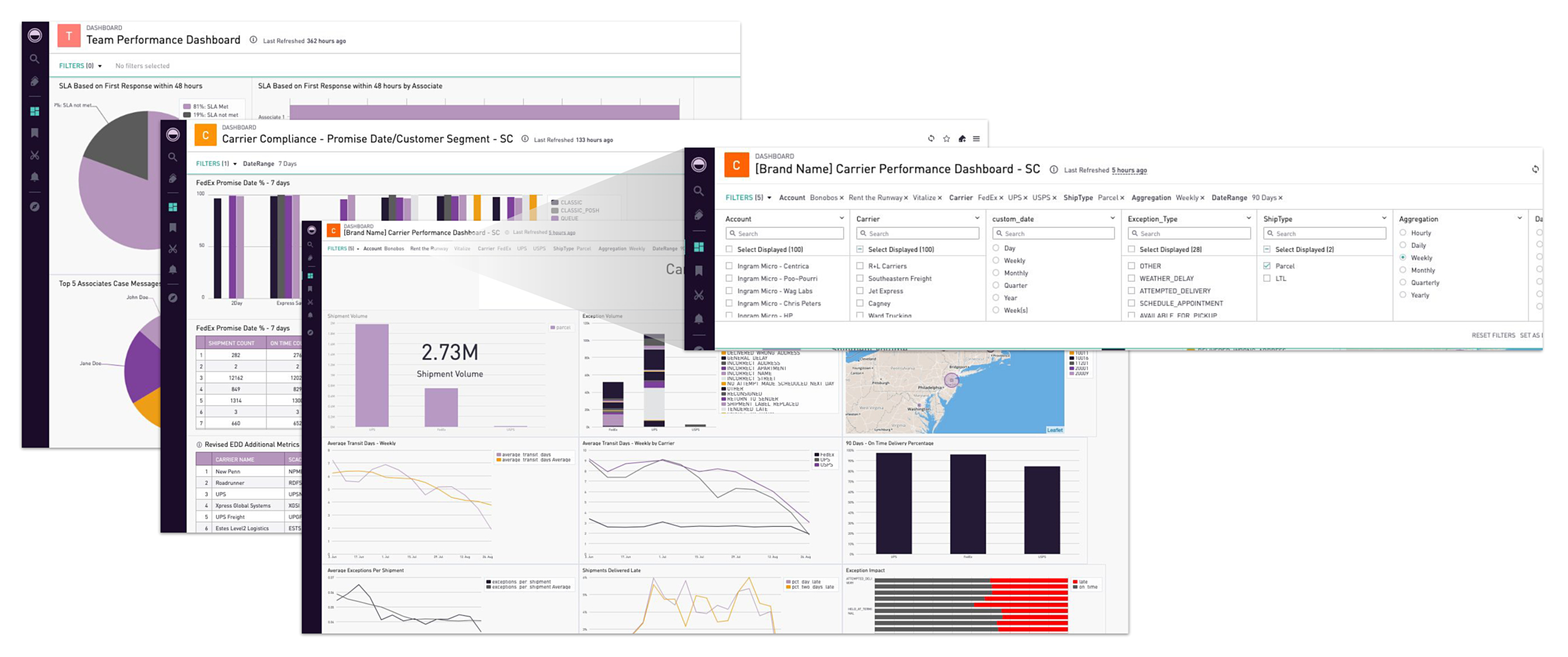

Convey recently unveiled a new suite of transportation insights as part of our Discover solution. These standard reporting ‘packs’ are designed to help retailers compete in the marketplace that Amazon and Wayfair have created. These reports enable retailers to better manage carrier performance and compliance, both to contractual SLAs and customer promises.

Without data, there is no context into problems. Without data, there is no control over the outcome. But without the ability to analyze the inputs, even the best data is meaningless.

Unlike traditional transportation reporting that focuses solely on standard measures like volume, on-time percentage, and exception rates, these reports are tailor-made for retail use cases. They include the ability to see last mile transportation data broken out by customer feedback, exception types, promise commitment performance, customer segment, and even product SKU.

Convey’s Discover product has enabled retailers large and small to improve their on-time deliveries by 25+%, increase NPS scores by 9.4%, and decrease transit times during peak season by >2 days by optimizing their networks.

All of these reports have been created with the intent of allowing users to quickly aggregate supply chain data, identify network issues, understand their root causes and act to save the delivery experience for thousands of customers. We hope that this supply chain data visualization enriches retailers everywhere, so they can make fast decisions to create more profitable and engaging customer experiences.

We’ve seen that when equipped with the right data at the right time retailers can save as much as $150k a year with no more than an hour a day investment.

What impact could you have with better visibility into your network’s performance? Talk to a sales rep and find out what insights you are missing.